Financial Planner Marketing Myth: Be sure to remind your clients that even during rising equities markets, that they should remain cautious and on the sidelines due to economic factors like sequestration, global events and deficit triggers. This cautiousness builds trust.

Reality: You’ve left your clients on the sidelines. Clients not only remember every dollar your recommendations may have cost them but they’ll equally remember each dollar they didn’t make based on your advice during a market run-up. When you talk to prospective clients “uncertain economy” is the fastest way to frighten them and reinforce why they shouldn’t invest. “Unpredictable times. It’s a good time to save. Let’s wait and see. I’m not sure about the current economy.”

IMMEDIATELY ELIMINATE THESE PHRASES OUT OF YOUR CONVERSATIONS, SCRIPTS, AND COMPLETELY OUT OF YOUR MEMORY.

Solution: Your marketing strategies should embrace investment gameplans for clients that is nimble and flexible, each tailored to take advantage of both up and down markets respectively. A Tampa marketing writer experienced in promoting financial services in all market conditions can help create your specific message and drive it home with client.

Financial Planner Marketing Myth: Prospective clients will slam the door hard with online marketing in uncertain market conditions due to the prevalence of scams. The senior investing dollar is unattainable via the web.

Reality: It makes sense that while the rest of the world leapt headfirst into online marketing and social media, investment houses and their financial planners along with other financial institutions have proceeded more cautiously. Due to security and privacy concerns, online marketing capabilities have been slower to grow in most financial service firms. Phishing scams have made many distrustful of an email. Once signed up and online, clients are comfortable transacting but the key is to get them as clients in the first place.

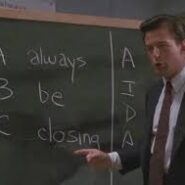

Solution: You need to have core competencies and convey your unique selling points and explain how you will meet clients’ needs better than your competitor – in all market conditions, not just in bad times. Financial planner online marketing strategies should encompass the primary traits on a traditional marketing campaign. If you have a referral name, always, always, always use that name in all correspondence to that particular prospect. Instant familiarity builds trust, name recognition and ultimately better business.